Thanks for reading. If you are enjoying this newsletter, be sure to give it a like and share it with a friend!

I was having a conversation with a friend and reliable skeptic about this new project, OceanESG, recently.

His first question was, ‘What is ESG. I mean, I know what the E,S, and G stand for, but what is it?’

I wish I had a good answer for him aside from, “You know it when you see it.”

But I knew this would happen, and is part of the reason I sought his insight and reality-checking to begin with.

While I understand the goal of ESG at a high level (the finding and rewarding of companies with a long-term focus that factors in sustainability, what drove me into exploring ESG was the clear lack of investment products that lived up to the promise (clear Wall St. greenwashing).

Beyond highlighting companies and trends making waves (pun!) in the blue economy, it is important to continue to understand ESG itself - what it is, what are the shortcomings, and how can I allocate capital in a truly meaningful way.

So, today I’ll focus on that first before moving on to the regular industry focus.

Understanding ESG Ratings

ESG ratings are a powerful force behind the creation of investment products like the ETFs you see labeled ‘clean’ or ‘sustainable’.

However, there are multiple ratings providers and they take different approaches to formulating an ESG score.

It is important to understand the methodology behind the ratings, which rating is being applied to a company/product you are interested in, and whether the combination of the two is actually achieving the investment goal you desire.

MSCI, the index provider, is emerging as a leader in this space and investment companies (like the BlackRocks of the world) are creating products based on their indices.

“No single company is more critical to Wall Street’s new profit engine (ESG) than MSCI…Yet there’s virtually no connection between MSCI’s “better world” marketing and its methodology.”

Understanding their methodology at a high level has helped explain my disappointment in the available investment products out there.

“The most striking feature of the system is how rarely a company’s record on climate change seems to get in the way of its climb up the ESG ladder—or even to factor at all.”

The article below, that provided the quotes above, is a great starting point to understand this situation better.

+MSCI, the largest ESG rating company, doesn’t even try to measure the impact of a corporation on the world - Bloomberg

Further…

What is the difference between ESG and Impact investing?

“Bain & Company helpfully distinguishes between those funds that are ESG “risk mitigators” and those that are ESG “opportunity seekers.”

Risk mitigators use ESG considerations to a limited extent to assess and manage potential risks during diligence and ownership, while opportunity seekers proactively look for investment opportunities that support environmental, social, or governance progress.”

+Why the world needs both ESG and impact investing - Bridgespan Group

Where there are problems, there is opportunity.

Capital continues to flow into this space.

As investors become better educated on the subtleties of ESG ratings they are sure to demand more mission-aligned products.

“Direct-indexed accounts, as such products are known, promise to track the performance of a benchmark index. But unlike off-the-shelf mutual funds or exchange-traded funds (etfs), which are pooled investment vehicles overseen by portfolio managers, investors in direct-indexed accounts own the underlying securities, and can tailor their portfolios to suit their needs.”

+The rise of personalized stock indexes - The Economist

As we’ve seen with products such as Engine No.1’s activist etfs, actually owning the security and not just the pooled vehicle will also allow individuals to vote in proxies at a company level.

One Ocean Summit

The One Planet Summit for the Ocean kicked off this week.

While I didn’t take the time to sit through it all like I will the upcoming Economist World Ocean Summit, there was plenty of chatter in the blue economy twitterverse about it.

Crimes at Sea Go Unaddressed

While the EU was up there highlighting everything it is doing to save us all from ourselves, Ian Urbina’s investigative reporting is a stark reminder that there are conflicts between words and action.

The environment isn’t the only issue out there.

“Tens of thousands of refugees crossing the Mediterranean Sea each year are captured by the EU-funded Libyan Coast Guard and sent to brutal prisons in Libya where murder, extortion and rape are common.”

+Is the UN’s maritime organization facilitating crimes at sea? - Outlaw Ocean Project

Ok. On to some news in key blue economy sectors.

Seafood and Aquaculture

Aquaculture is already the fastest-growing segment of our food system and will continue to be an important source of protein globally.

Technology and capital are increasingly focused on this sector and will help to alleviate some of the traditional problems with environmental degradation and traceability.

“[Aquaculture] …it’s often neglected in broader conversations about achieving a regenerative, nature-positive food system, in part because of its perceived history of environmental degradation.”

+Aquaculture critical for feeding the world in a changing climate - Nature Conservancy

“Right now, growing the vast majority of our food requires land to produce. And almost all of the world’s fertile land is already in use. Our ocean, by contrast, covers nearly three-quarters of the planet, yet currently provides just 2% of our food. Not only is there room to grow here, there’s room to grow smartly.”

+Aquaculture: why the world needs a new wave of food production - World Economic Forum

How we feed these fish is a key path towards improving aquaculture sustainability and economics.

+Comparative terrestrial feed and land use of an aquaculture-dominant world - PNAS

“The constrained supply picture, therefore, “supports multi-year high prices, given the expected good demand.”

+Rabobank sees strong outlook for aquaculture amid Covid recovery - Global Seafood Alliance

Shipping & Ports

The shipping industry is undergoing its own energy transition. However, prices are volatile as new fuel supply chains develop and mature.

At the end of the day, while regulation and a carbon price is needed, it is economics that will drive most of these decisions.

“With spot LNG having traded, in the past, at the equivalent of more than $200 per tonne more expensive than LSFO… It has been reported that some older LNG tank carriers that can run on a combination of the boil-off gasses from their cargo and fuel oil have opted to run entirely on fuel oil to achieve cost savings.”

“Meanwhile, as bunker prices soar (with the price of oil, my context), the spread between compliant low-sulfur fuel oil (LSFO) and heavy fuel oil (HFO) continues to widen, shortening the period of scrubber installation payback for shipowners and operators.”

+Rising LNG bunker costs not deterring carrier newbuilds - gCaptain

Ocean Renewable Energy

Offshore wind continues to suffer from supply chain issues despite global commitments to scaling this important source of future renewable energy.

We’ve discussed almost every week how investors in this sector are getting crushed by declines in equity prices of over 75% in some cases.

+Sapura leaves offshore wind project mid-construction - OffshoreWind.Biz

+A renewable energy bubble is hit by the perfect storm - Bloomberg

Energy Transition & Carbon

Again, the economics.

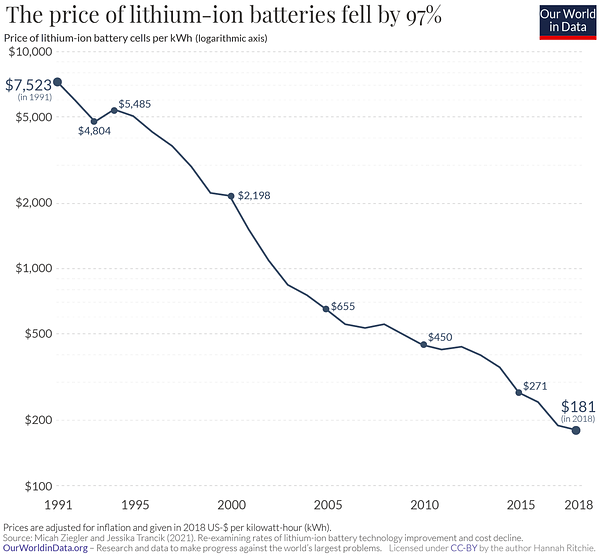

As the declining cost of renewable power is increasingly coupled with cheap storage options, adoption will scale due to the economics, regardless of legislation and the political climate of the moment.

+The price of batteries has declined by 97% in the last three decades - Our World In Data

I love Dan Neil. Here’s a great article highlighting why the auto industry is focusing on EVs as opposed to hydrogen-powered cars.

However, as we’ve seen in this newsletter, a blue-hydrogen economy is certainly going to be a part of the energy mix going forward.

+Dude, where’s my hydrogen-powered car? - WSJ

Carbon to the Moon

Speaking of economics, the price of carbon (based on the EU’s pricing mechanism) continues its upward trajectory towards $100.

Personally I believe this is inevitable and am an investor in GRN, an etf that stands to benefit from this trend. **NOT INVESTMENT ADVICE**

While there are many benefits to a higher carbon price in enabling the energy transition, and many believe it is necessary, there will be a political price to pay (as highlighted by Reuters energy analyst John Kemp below).

As he also points out, the carbon market is not a true market in the sense of a commodity like oil or gold. Politicians can step in to change the supply of carbon credits available to purchase, or put limits on prices.

“The potential for unpredictable and damaging price volatility is why cap-and-trade systems are generally inferior to carbon taxes that provide gradual and predictable increases in the cost of emissions.”

+EU Emissions prices become politically sensitive: John Kemp - Reuters

+Carbon credits encroach on $100, as EU looks to curb self-imposed cost - Seeking Alpha

Where do carbon credits come from?

(Plus, a cool good-news success story.)

“In the Atlantic Ocean, off Virginia’s southern coast, a meadow of underwater grass has been inching along for roughly 25 years. Now close to ten thousand acres wide, it’s poised to become the world’s first verified seagrass-based carbon credit program.”

+On coastal Virginia’s barrier islands: Blue carbon credits by the books - Forbes

So cool. And this data being pushed through the verification process will open the doors for funding more projects like this with carbon credits.

Marine & Coastal Tourism

This week we’ll take a break from bashing the cruise ship industry to learn a bit more about the big tourism picture.

“At present, tourism represents 40% of the blue economy – as the largest share in export value according to the United Nations Conference on Trade and Development (UNCTAD).”

+Tourism leaders call for urgent action to protect the oceans - Hospitalitynet

It’s a little unclear who these leaders were ‘calling for action’ from.

Seems like there is plenty of action to be done in their own operations and supply chains.

+Global tourism plastics initiative - OnePlanetNetwork

The reality is that tourism supports millions of jobs world wide and can be a major contributor to GDP. I just found this segment of the UN focused on tourism and will continue to dive deeper.

+UN World Tourism Organization

Cool Jobs in the Blue Economy

+Fisheries Economist - Sustainable Fisheries Partnership

+Co-general manager - Urchinomics

Visual Stories

If you’re into data visualization, the ocean, and action against IUU fishing, this is the page for you.

+A radar-illuminated ocean reveals dark fleets - Global Fishing Watch

Luzzo

I know what I’ll be streaming this weekend.

Have a great weekend.

Doug